TAMPA, Fla. -- It’s 2017. Tampa International Airport continues to set new passenger records and move forward with its multibillion-dollar expansion project.

But for as proactive as the airport authority has been on constructing its future, it appears to be taking a slow and reactive approach toward a technology rapidly changing its business model: ridesharing.

Uber and Lyft have dramatically altered how passengers get to and from the airport, causing significant drops in airport revenues from parking and rental cars – the two traditional ground transportation options the airport has bet its future on and planned Phase 1 of its expansion around.

“We’ve made this huge bet on rental cars that I don’t know if it’s going to pay off,” said State Sen. Jeff Brandes (R, St. Petersburg), who helped initiate an audit of the airport’s multi-phase construction project last legislative session. “I would love to see them move faster (on emerging technology).

After 10Investigates’ July report on how the Hillsborough County Aviation Authority will initiate new fees on Uber, Lyft, and taxicab fares from the airport, the investigative team dug into the airport’s budget and found the fees come after the agency missed several projections on parking and rental car revenues.

The airport also hadn’t adjusted its master plan to accommodate the disruption caused by new technology until this summer, when it added new curbsides at each terminal and scaled back Phase 2 of its expansion, even though Uber was first introduced to the Tampa market five years ago at the Republican National Convention and started impacting airport revenues at least two years ago.

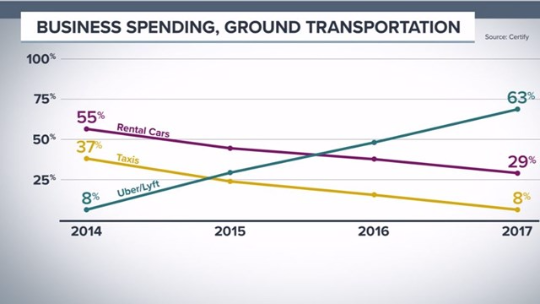

According to business management firm Certify, ridesharing now accounts for 63 percent of U.S. business travelers’ ground transportation expenses, eclipsing rental cars (29%) and taxicabs (8%) combined.

The largest portion of the airport’s construction project adds “people movers” that will connect travelers with a new, centralized rental car facility. The facility has been heralded by Tampa International Airport (TIA) CEO Joe Lopano as one that will "give our guests access to twice as many rental car choices" and remove 8,000 cars per day from airport roads.

But the 8,000 cars reflect short trips taken on the airport’s main roads and back roads – not the terminal curbsides, where there is often the most congestion, especially as ridesharing grows. And those estimates were based on a 2011 study, taken during peak season, and prior to the beginning of ridesharing in Tampa.

The airport hasn’t yet addressed the increased congestion from Uber and Lyft vehicles picking passengers up at the curbsides.

“Were we too late? Maybe,” Lopano said, responding to a question about the speed of which the airport has responded to new technology. “But I think we have the right solution.”

SLOW TO PIVOT ON RIDESHARING

As recently as April 2017, one airport executive downplayed the impact of ridesharing when asked by board members, suggesting the airport has merely “pulled the numbers down a little bit” on its future revenue projections.

But despite record growth in passengers – expected to cross 10,000,000 enplanements for the first time this year – rental car transactions at Tampa International stopped growing after 2015, while annual revenues have dropped by $4 million since then.

And the airport will miss its parking revenue estimate by more than $3 million in 2017 despite more travelers heading to the airport.

Some supporters of ridesharing say adjustments for the changing transportation model are coming too late, while some in the taxi and limousine industry say the new fees on rideshare pickups are also long overdue. But none seem happy the airport wants to charge $5 per pickup to make up for lost rental car and parking revenues.

“That’s a huge increase to our passengers,” said Tom Halsnick, owner of Black Pearl Limousine. “Three dollars should be the maximum for the fee (the airport) can charge.”

“I’ve always had some concerns about how the rental car numbers would play out,” Brandes said. “I want to look at their numbers and say, ‘how is rideshare disrupting the rental car business? How many people aren’t parking long-term now because it’s cheaper simply to take an Uber or Lyft to the airport?”

10Investigates first questioned Lopano about the risk the airport was undertaking with the rental car facility back in 2015.

The airport authority’s 2018 budget, presented to the board on Thursday, finally acknowledged that competition from ride-sharing is impacting parking revenues.

And rental car taxes, which are the main source of funding for the airport’s multi-billion-dollar construction, will only pull in $43 million in 2017; that’s more than $2 million below projections and more than $1.5 million below 2016 numbers, despite surging passenger growth. Profit-sharing from TIA rental car companies is also down millions in the last two years.

But Lopano says the few million dollars lost in ground transportation has been made up in better-than-expected cargo and concessions revenues, and the airport’s overall revenues are proof things are going well. Although the overall figures missed several earlier estimates and goals, the $216 million in 2017 revenue will be the airport’s highest ever. Expenses are below revenues and the airport's reserves have grown.

“We are good stewards of this asset,” Lopano said. “It’s one of the best assets in our region (and) we’re continuing to grow...Air service continues to go up; our international service has doubled...so the local people can rest assured that the airport is going to be in good shape.”

Lopano also points to another big-picture benefit of creating the rental car facility: freeing up space in the airport’s garage and main terminal for future expansion.

“That’s the importance of this (project is) to allow growth in this building without having to go to a new one,” Lopano said of the nearly 50-year-old airport facility.

RIDESHARE, LIMO, TAXI FEES

Lopano says adding pickup fees for Uber, Lyft, taxis, limos, and shuttles is simply shifting some of the airport’s expenses to the companies that profit there, just as it does with rental car companies, airlines, and other concessionaires.

Each time a Lyft or Uber vehicle picks up passengers at the airport, the companies will use their respective apps’ GPS to impose a $3 fee. The companies will then self-report the numbers and remit payments to TIA. Taxicabs, shuttles, and courtesy vehicles will start paying similar fees in the spring when the airport installs AVI technology, similar to SunPass readers. All prices will then climb by $1 in October 2018, and by another $1 in October 2019.

“It’s appropriate for us to recover our costs,” Lopano said, referring to the airport’s cost to maintain its roads, lots, and other transportation-related expenses. “Everyone who uses the airport to make money should pay their fair share airport.”

Airport executives repeatedly said the amount of the pickup fees – higher than most other airports in Florida – was determined by its annual ground transportation expenses, divided by the number of expected commercial pickups.

Consulting firm LeighFisher estimated TIA's annual ground transportation expenses to be $5.4 million per year: $500,000 of which was direct ground transportation expenses; $3.8 million due to indirect expenses like airport administration and roads; and $1.1 million to depreciation on resources like parking lots and the airport’s main parkway. It also includes a $160,000 annual bill to maintain the AVI system plus a depreciation schedule on the system of $188,000 annually.

“I question that figure,” Halsnick said of the airport’s ground transportation costs. “A (planned fee of $5 per pickup) is a huge difference (to customers)...sometimes a deal-breaker.”

CHEERLEADER-IN-CHIEF

Lopano is a tireless advocate for the airport, consistently rated by passengers as one of the three-best in the nation. And he says the best is yet to come when construction is done.

“It’s going to be pretty awesome,” Lopano said. “We broke a record for passengers; we broke a record for revenues; so I think the performance (to-date) speaks for itself.”

Lopano received a job performance rating of 4.96 – out of 5.00 – from board members last week, and is due to receive a $60,000 raise next April, taking his salary to $452,898.

He is popular among business leaders and his board. But for as easily as Lopano and his administration have provided good news to the airport’s board members, the flow of news about possible challenges has been considerably slower.

During an April 2017 budget workshop, aviation authority board member and county commissioner, Victor Crist, asked about financial challenges the airport was facing from Uber and Lyft.

The airport’s executive vice president of finance and IT, Damian Brooke, responded, “when you look at our transactions for the rental cars right now, the transactions are actually holding firm.”

Brooke did not disclose that the rate of passengers who rent cars at TIA was dropping or that those who rented cars were spending considerably less on rental cars.

He continued to tell the board, “what we have done in these projections is we’ve taken a very conservative approach in the parking ground transportation side because as we look forward, you know, with the growth of (ridesharing) so and so forth, we’ve pulled the numbers down a little bit, again just to be conservative.”

But four months ago when the comments were made, the airport – and many other airports around the country – already had significant evidence ridesharing was hurting revenues and disrupting business models.

That business model will again be under the microscope on Wednesday, when Lopano and his staff meet with the companies that rate the airport’s billion-plus dollars in bonds. Two years ago, Lopano boasted to 10Investigates about the airport’s plan and rental car numbers, “the guys on Wall St. liked it.”

If the agencies still like the plan, it could help the airport lower future interest rates. If the bond rating agencies are concerned about any red flags, it could cost the airport millions.

CHANGES UNDERWAY & TIA’s FUTURE

Tampa International Airport is in the process of revamping its restaurants, shops, and concourses. Its expansion/modernization project will also open up more space and consumer options in the main terminal as well as operational improvements behind-the-scenes.

Phase 1 of the project, which includes the rental car center and people mover system, is expected to finish in early 2018.

Phase 2 funding was just approved by the airport board and will bring – among other things – additional curbsides at each terminal to alleviate congestion from rideshare pickups and drop-offs. But Phase 2 has been scaled down; now less complex and less costly than originally proposed.

Future construction (Phase 3) could add a new “D” airside terminal to accommodate a need for new gates, but Lopano says TIA’s gates are actually underutilized right now since airlines are running bigger planes and selling a higher percentage of their seats.

Brandes says he would like to see the airport move faster on new technology, but there is still time to have discussions about a future with electric and autonomous vehicles. He even suggested the rental car facility could be a future hub of the region’s autonomous vehicle fleet if the “shared economy” replaces individually-owned vehicles.

Lopano responded to Brandes' vision by saying the airport is keeping its options open and is in a good position to pivot toward new technology when the time comes.

Find 10Investigates' Noah Pransky on Facebook or follow his updates on Twitter. Send your story tips confidentially to npransky@wtsp.com.